Equipment Financing Restaurant: A Practical Guide for Los Angeles Kitchens

Share

So, you’re ready to open a restaurant in Los Angeles. Whether it's a bustling Koreatown BBQ joint, a Thai food kitchen in the Valley, or a hip food truck hitting the streets of Silver Lake, one thing is certain: you're going to need some serious kitchen equipment. And that gear, from commercial refrigerators to specialized cooktops, doesn't come cheap.

Smart operators know that dropping all your cash on hardware upfront is a rookie mistake. Equipment financing for a restaurant is more than just a loan; it's a strategic move that keeps your capital free for the things that really keep the lights on—rent, payroll, and marketing. It's how you get the doors open and start making money, faster.

Fueling Your Culinary Ambition Without Draining Your Capital

Let's be real. Starting a restaurant in the L.A. food scene is a massive undertaking. Your dream of slinging authentic Mexican tacos, plating delicate Japanese sushi, or perfecting that spicy Thai curry needs a fully loaded, professional kitchen to become a reality. This is true whether you're in a brick-and-mortar or running one of the many Los Angeles food trucks.

The price tag for outfitting a new kitchen can be a shock. Just the essentials—commercial refrigerators, freezers, ranges, and prep tables—can easily run you $150,000–$300,000. That's a huge chunk of change. This is why lease-to-own programs have become a lifeline for independent owners in a pricey market like Los Angeles, where every dollar of cash on hand is critical.

Why Financing Is a Strategic Move for LA Restaurants

Opting for equipment financing for your restaurant isn't just about saving money today. It’s about setting your business up for long-term success. When you finance the big-ticket items like walk-in freezers or high-capacity ovens, you keep your working capital liquid and ready for what matters most.

That cash can go directly toward:

- Scoring a prime location, from a high-traffic spot in DTLA to a cozy corner in the Valley.

- Hiring and training your dream team to bring your culinary vision to life.

- Marketing and promotion to build that crucial opening day buzz and reel in your first loyal customers.

- Stocking your pantry with all the fresh ingredients you need, whether it's for Chinese dim sum or a Korean-inspired brunch.

Think of it this way: financing your equipment lets you invest in your restaurant's engine without emptying the gas tank. It’s the key difference between just opening your doors and actually opening for a successful, sustainable run.

Ultimately, financing allows you to get the absolute best restaurant equipment from day one. And when you have reliable, professional-grade gear, you can nail your recipes, streamline your kitchen workflow, and serve up a consistently fantastic experience for every single guest who walks through your door.

For a closer look at all the initial steps, be sure to check out our complete guide on how to start a restaurant business, which breaks down the foundational planning you'll need.

Navigating Your Restaurant Financing Options

Figuring out how to pay for your kitchen is one of the first, and most important, steps in building a restaurant that lasts. Whether you're outfitting a brand new food truck or finally upgrading the commercial refrigerators at your established Thai spot, you’ve got a few ways to go. The right choice really comes down to your business, your cash flow, and where you see yourself in a few years.

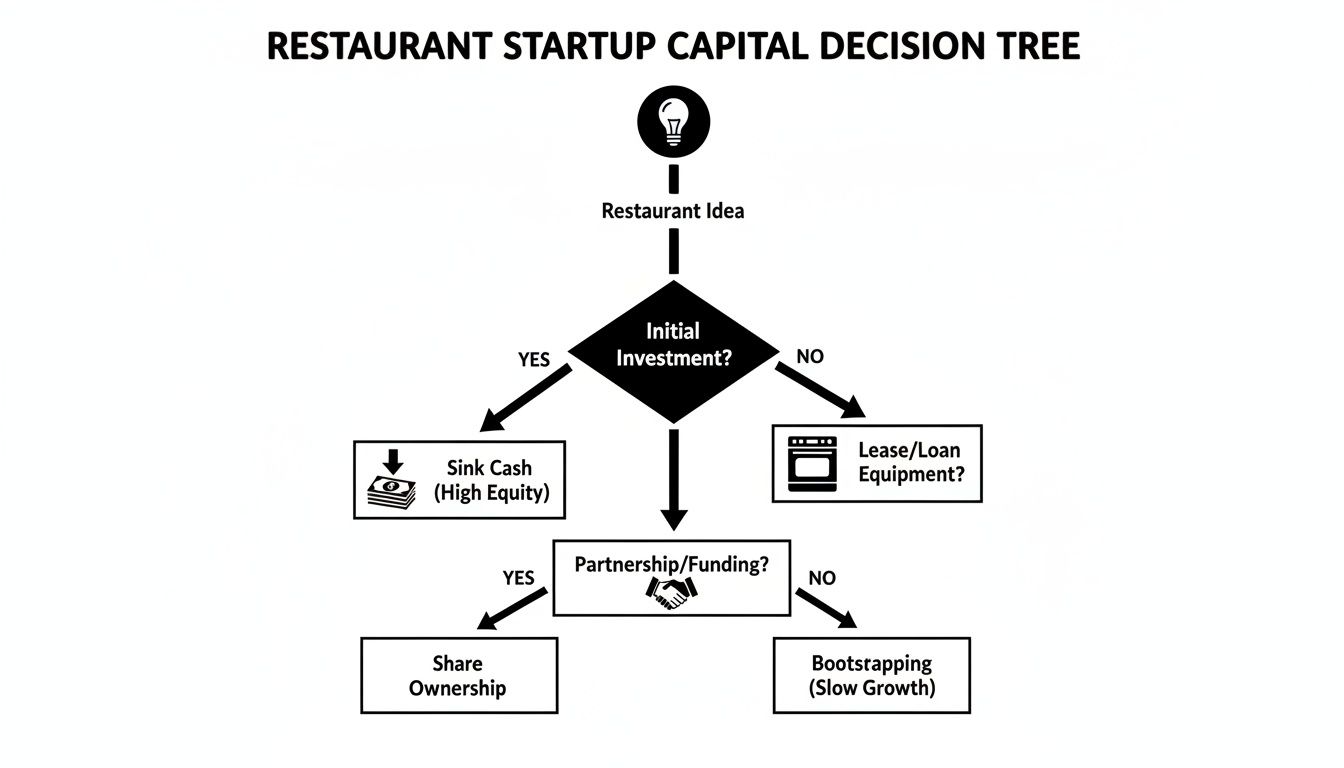

For most restaurant owners here in Los Angeles, it all boils down to protecting your cash. This decision tree lays out the basic choice: pay for everything upfront or finance it over time.

As you can see, financing frees up your money for other crucial things like marketing, payroll, or just surviving a slow month—all essential for making it in a market this competitive. Let's break down the most common ways to get it done.

Traditional Bank Loans

A traditional loan from a bank, like an SBA 7(a) loan, is what most people think of first. You get a lump sum of cash to buy what you need and pay it back with interest over a set term.

This route is often a solid choice for an established, well-known Chinese restaurant in the San Gabriel Valley that wants to do a full kitchen remodel. They’ve likely been around for years and have the strong credit and paperwork to back up their application. But it’s not for everyone.

- Pros: Bank loans usually come with lower interest rates, and the best part is you own the equipment from day one.

- Cons: The application process is famously slow and bureaucratic. You'll need an excellent credit score, a mountain of paperwork, and often, you’ll have to put up some serious collateral. That’s a tough barrier for a new spot just getting off the ground.

Equipment Leasing

Think of equipment leasing as a long-term rental. You make a fixed monthly payment to use the equipment for a specific period. When the lease is up, you generally have a few options: return it, sign a new lease, or in some cases, buy it out.

A new Japanese sushi bar opening in Little Tokyo might go this route for a top-of-the-line commercial freezer. It keeps their initial startup costs way down and gives them the freedom to upgrade in a few years when newer, better tech comes out.

Leasing is a smart way to stay current. Kitchen tech, especially cooking and refrigeration equipment, is always improving. A lease keeps you from getting stuck with outdated gear.

Lease-to-Own Programs

A lease-to-own program is the best of both worlds. It gives you the flexibility of a lease but with the end goal of actually owning the equipment. A portion of every payment you make goes toward the purchase price.

At the end of the term, you can usually buy the equipment for a tiny amount, often just $1.

This is a complete game-changer for startups, like a new Mexican food truck that needs a dependable griddle and prep station but can't afford to drain its bank account. You get the gear you need to start making money immediately, all while building equity. It’s also a fantastic way to build up your business credit with steady, on-time payments.

To see if this strategy is the right fit for your kitchen, take a closer look at the benefits of a restaurant equipment lease-to-own program and how it all works.

The Essential Checklist for Securing Equipment Financing

Applying for equipment financing for your restaurant shouldn't be a painful process. If you do your prep work, you can walk into any lender's office with confidence, whether you're kicking off a Korean BBQ food truck in Westwood or just upgrading the commercial freezers at your Thai spot in North Hollywood.

Think of it like your kitchen’s mise en place—getting everything organized beforehand makes the whole thing run a lot smoother.

Lenders are looking for a clear, compelling story. They're not just funding equipment; they're investing in your vision, whether it’s a high-end Japanese sushi bar or a fast-casual Mexican taco joint. Having your documents in order shows them you’re a serious operator who gets the competitive Los Angeles food scene.

Your Business Plan and Financials

First thing's first: your business plan. This is your chance to sell your concept. Get specific. Detail your menu, who you're trying to feed, and what makes your restaurant stand out. Are you the only authentic Chinese dumpling house for miles? Or a Los Angeles food truck specializing in Korean-Mexican fusion? That's a key detail. You’ll also need to include some realistic financial projections for the next three to five years.

Along with that plan, you'll need the hard numbers. Lenders almost always ask for the same set of documents:

- Business Bank Statements: The last three to six months should do it. They want to see your cash flow.

- Tax Returns: Have both your personal and business returns from the past two to three years ready.

- Profit & Loss Statements: If you're already open, this is crucial for showing you’re making money.

- Balance Sheet: This gives a quick snapshot of your restaurant’s overall financial health.

A solid business plan does more than just check a box. It proves to a lender that you've thought through every angle, from your marketing to your monthly food costs. It’s your best shot at showing your LA restaurant concept is built to last.

Equipment and Personal Information

Next up, you need a detailed quote for the specific restaurant equipment you want to finance. Don’t just write down "commercial freezer." You need the make, model, and price. It shows you’ve done your research. If you need a good rundown of what to look for, our commercial kitchen equipment checklist is a huge help.

Finally, get your personal info in order. Lenders will pull your personal credit, so it’s a good idea to check your own report first to handle any surprises. You'll also need basic ID and proof that you own the business, like your articles of incorporation or business license.

Having all this ready to go will make the approval process so much faster, getting that new griddle or walk-in freezer into your kitchen where it belongs.

Understanding the True Cost of Your Equipment

When you're outfitting your restaurant, it’s all too easy to get fixated on the sticker price of that brand-new commercial freezer or six-burner range. But if you’re financing, the real cost of that equipment is buried in the details of the deal. To make a smart play for your Los Angeles eatery, you have to get comfortable with the language lenders use.

That initial quote is just a starting point. The numbers that really matter are terms like Annual Percentage Rate (APR), interest, and the total borrowing cost—these are what determine what you’ll actually pay over time. A low monthly payment might catch your eye, but it could be hiding a much higher overall cost if it’s stretched over a longer term.

Demystifying Key Financial Terms

Think of APR as the all-in, yearly cost of borrowing the money. It’s not just the interest rate; it also rolls in any lender fees, giving you a much clearer picture of the deal. When you're comparing offers, lining up the APRs side-by-side is the only way to see which one truly saves you money.

Here’s a quick breakdown of what to watch for:

- Interest Rate: This is what the lender charges you for the privilege of using their money, shown as a percentage.

- Loan Term: This is simply how long you have to pay it all back. You’ll usually see it in months, like 36, 48, or 60 months.

- Total Borrowing Cost: This is the big one—it’s the original equipment price plus all the interest and fees you’ll pay over the entire term.

Getting a handle on these three elements will help you dodge any nasty surprises and make sure the financing deal actually supports your restaurant’s profitability, whether you're serving Mexican, Thai, or Korean food.

Modeling Your Repayment Scenarios

Let’s run some real-world numbers. Say your new Japanese spot in Sawtelle needs a $20,000 equipment package—maybe a top-of-the-line commercial freezer and a new stainless steel prep table.

You'll likely face two common financing scenarios:

- A 36-Month Term: Your monthly payments will be a bit higher, but you'll pay way less in total interest and own the gear free and clear much sooner. This is a great move for maximizing your long-term profit.

- A 60-Month Term: The monthly payments will be lower, which can be a lifesaver for your immediate cash flow. The trade-off? You'll pay a lot more in interest over the five-year term.

A shorter term is an aggressive way to build equity in your business assets. A longer term is all about keeping more cash on hand for payroll, inventory, and other daily operations. There's no single "right" answer—it's all about what your restaurant’s financial strategy demands right now.

This kind of cost-benefit thinking is critical. For many quick-service restaurants, kitchen equipment can easily account for 20–30% of the total build-out cost. Add in the fact that ongoing maintenance can chew up another 3–5% of your revenues, and you can see why finding a financing package that bundles in warranties and service can be a game-changer for stabilizing your monthly expenses. You can dig into more data on how financing impacts restaurant operations on intelmarketresearch.com.

By taking the time to model these scenarios, you can confidently choose a path that fuels your growth without putting your budget in a chokehold.

How Financing Builds Your Business Credit and Cash Flow

Thinking about equipment financing for a restaurant? It's about so much more than just getting a new commercial freezer or range into your kitchen. When you do it right, it becomes a powerful tool for building a rock-solid financial foundation for your entire business. You're not just buying equipment; you're setting your restaurant up for long-term success.

Every single on-time payment you make on an equipment loan or lease gets reported to the business credit bureaus. This is huge. It works just like paying off a personal loan to build your personal credit—that consistent history helps establish and grow your business credit score over time.

A strong business credit profile is an invaluable asset. It opens doors to better terms and lower interest rates on future financing, whether you're dreaming of opening a second location in Los Angeles, overhauling your entire kitchen line, or just need a line of credit to smooth out cash flow.

Aligning Payments with Your Restaurant's Rhythm

One of the toughest parts of running any L.A. restaurant, from a Koreatown BBQ spot to a Thai Town favorite, is managing the unpredictable flow of cash. Your revenue can swing wildly with the seasons, holidays, and even what’s happening in the neighborhood. Smart financing helps you ride out those peaks and valleys.

It’s absolutely critical to structure your payments to match your cash flow. For instance, if you know you’re slammed during the summer, you could arrange for slightly higher payments then and smaller ones during the slower winter months. This keeps your financing from becoming a dead weight when cash is tight.

A lease-to-own program is a game-changer here. It gives you predictable, fixed monthly payments. This makes budgeting so much easier than juggling fluctuating credit card bills or getting hit with the sticker shock of a major equipment repair. You can actually allocate your funds with confidence.

Investing in Efficiency and Profitability

Financing gives you the immediate ability to invest in modern, high-efficiency restaurant equipment that directly boosts your bottom line. This is especially true for commercial refrigerators and freezers—the real workhorses of any commercial kitchen, from a Chinese dim sum parlor to a Japanese ramen shop.

The industry data backs this up. A recent study showed that 73% of restaurant operators boosted their tech investments, focusing on high-productivity gear like combi ovens and energy-efficient refrigerators. Here in the U.S., cooking equipment typically makes up 31–35% of purchases and refrigeration another 24%. Financing these key items has a direct impact on your profitability and how you manage your capital. You can dig into more of these restaurant industry trends on eisneramper.com.

By financing, you get your hands on top-tier equipment that immediately starts working for you:

- It lowers your utility bills with better energy efficiency.

- It reduces food waste because of more reliable temperature control.

- It cranks up kitchen output with faster cooking and prep times.

This is how you turn a necessary expense into a strategic investment that literally pays for itself over time.

Your Restaurant Equipment Financing Questions, Answered

When you're looking into equipment financing for a restaurant, a few key questions always come up. Here are the straightforward answers every Los Angeles restaurant and food truck owner needs to know.

Can I Get Equipment Financing For A Food Truck With Bad Credit?

Yes, you often can. For many lease-to-own programs, especially those built for the fast-moving L.A. food scene, your personal credit score isn't the whole story.

Lenders are more interested in your business's potential. They'll look at your business plan for that new Korean fusion truck, check out your projected cash flow, and consider your experience in the industry. Putting some money down can also make a huge difference in strengthening your application. The best move is always to talk directly with a financing provider about your specific situation to see what they can offer.

What Is The Difference Between Leasing And A Lease-To-Own Program?

A standard lease is essentially a long-term rental. You get to use the equipment—say, a commercial freezer for your Thai Town spot—and when the term is up, you give it back.

A lease-to-own program, on the other hand, is designed from the start to make you the owner. A slice of every payment you make goes toward the final purchase price. Once the term ends, you can typically buy the equipment outright for a symbolic amount, often just $1. This is a great way to build tangible assets for your Chinese restaurant or Japanese sushi bar.

Think of it this way: leasing is renting, while lease-to-own is a clear path to ownership. For a startup, building equity in your kitchen gear is a massive long-term advantage.

How Quickly Can I Get Approved For Kitchen Equipment Financing?

The approval process is usually much faster than going through a traditional bank. For most equipment financing restaurant applications, especially for amounts under $100,000, you can expect a decision within 24 to 48 hours after you've submitted all your paperwork.

This kind of speed is a game-changer for L.A. owners who need to replace a broken-down piece of equipment yesterday or get a brand-new spot up and running without any delays.

Ready to get the professional-grade equipment your Los Angeles restaurant deserves? The team at Los Angeles Restaurant Equipment is here to help you secure fast, flexible financing that works for your budget and your vision. Explore our lease-to-own program and get started today at https://losangelesrestaurantequipment.com.