A Guide to Restaurant Equipment Financing in Los Angeles

Share

Restaurant equipment financing is a savvy way for Los Angeles eateries to get the essential kitchen gear they need without paying the full price tag all at once. It means you can get everything from commercial refrigerators to specialized cooking ranges with manageable payments, keeping your cash free for day-to-day operations. It’s more than just a way to buy things; it's a vital tool for growing your business in L.A.'s competitive food scene, whether you're running a food truck or a brick-and-mortar restaurant.

Why Smart Financing Is Your Kitchen’s Secret Ingredient

For any Los Angeles restaurant owner, the real challenge is always balancing your big ambitions with your budget. It doesn't matter if you're launching a Korean BBQ spot in Koreatown, a busy Thai food truck, a sleek Japanese bistro downtown, or a beloved Mexican restaurant—the right equipment is everything. But top-tier commercial refrigerators, freezers, and ovens come with a steep price that can wipe out your capital.

This is where smart restaurant equipment financing becomes your secret ingredient for success. It turns a huge upfront expense into a predictable monthly cost, freeing up your money for other critical things like payroll, marketing, or buying inventory.

Powering Growth in the LA Food Scene

Think about it this way: instead of dropping $20,000 in cash on a new kitchen line, you could finance it. Then, you can use that $20,000 to hire another chef or launch a marketing campaign that brings in hundreds of new customers. This kind of thinking is what keeps you nimble, whether you're upgrading an old kitchen or building a new one from scratch.

Financing lets you:

- Get Better Equipment: You can afford the high-performance, energy-efficient gear you actually need, not just what you can pay for in cash today.

- Keep Your Cash Flowing: Your cash reserves stay healthy for surprise opportunities or emergencies.

- Match Costs to Income: You pay for the equipment as it's helping you make money.

And this isn't some niche strategy; it’s how business gets done. In 2023, the equipment finance industry ballooned to a record $1.34 trillion. A whopping 82% of businesses, including countless restaurant owners, now use financing to get the tools they need. This just shows how crucial financing has become for everyone, from Los Angeles food trucks needing commercial freezers to Chinese restaurants upgrading to powerful convection ovens without draining their bank accounts.

A Path to Success for New and Established Restaurants

Financing isn’t just for brand-new spots. An established Mexican restaurant might use it to add a new line of commercial refrigerators to keep up with demand. A new Los Angeles food truck can get fully decked out without a crippling upfront cost. It really levels the playing field, giving passionate chefs and entrepreneurs the tools to compete.

If you’re just getting started, it’s key to understand the whole picture of opening an eatery. For a deep dive, check out our guide on how to start a restaurant business for a complete roadmap.

Decoding Your Primary Financing Options

When you're diving into the world of restaurant equipment financing, it can feel a little overwhelming. But it’s much easier to wrap your head around when you think about it in terms of the Los Angeles food scene. Each financing option is really just a different tool, designed for different business goals, budgets, and timelines. Getting a handle on these choices is your first step to building out a dream kitchen without emptying your bank account.

It’s like this: a Japanese sushi spot in Little Tokyo needs a very specific kind of refrigerated display case, while a Mexican restaurant in East LA needs a massive, high-capacity griddle. In the same way, your business needs a financing tool that fits its own unique financial recipe. Let's break down the most common options available to L.A. restaurateurs.

Equipment Loans: The Path to Ownership

An Equipment Loan is about as straightforward as it gets. It works almost exactly like a car loan: a lender gives you the cash to buy your equipment, and you own it from day one. You then make fixed monthly payments over a set period until it's paid off.

This is a great route for established spots that want to build equity. Imagine a popular Korean BBQ joint in Koreatown looking to upgrade its commercial refrigerators and freezers. A loan makes sense because they get a valuable asset on their books right away and can start taking advantage of tax depreciation.

Operating Leases: The Flexible Rental

Think of an Operating Lease as renting an apartment for your equipment. You get to use the gear for a specific amount of time—usually one to three years—and your monthly payments are typically lower than a loan. When the lease is up, you can simply return it, renew the lease, or even upgrade to the latest model.

This is the perfect play for businesses that need to have the newest tech without being locked into ownership. A trendy Thai food truck that cruises through Venice and Santa Monica might lease a state-of-the-art combi oven. This keeps their monthly expenses low and lets them swap for a newer model in a few years, making sure their kitchen tech never falls behind.

Lease-to-Own: The Best of Both Worlds

A Lease-to-Own plan is a lot like a 'rent-to-own' deal for a house. You make regular lease payments, but a piece of every payment is chipping away at the purchase price. At the end of your lease term, you usually get the option to buy the equipment for a set price—often as low as $1.

This hybrid model offers amazing flexibility, which is why it’s so popular with new restaurants or places with unpredictable cash flow. You get the must-have restaurant equipment you need right now, but you keep the door open to owning it down the road.

Picture a new Chinese restaurant opening up in the San Gabriel Valley. They need a complete kitchen line—commercial refrigerators, freezers, the works—but need to save as much cash as possible for their grand opening. A lease-to-own program lets them get everything with payments they can handle, giving them the peace of mind that they'll own these essential assets once the business is on solid ground.

SBA Loans: The Government-Backed Powerhouse

SBA Loans, which are backed by the Small Business Administration, are well-known for their fantastic interest rates and long, friendly repayment terms. They are a serious tool for big investments, like a full kitchen renovation or buying a whole suite of new restaurant equipment all at once.

The catch? The application process is famously detailed and can be slow. Lenders want to see everything: in-depth business plans, financial projections, and a strong credit history. The low rates are tempting, but if your commercial freezer dies on a hot summer day, you probably don’t have time to wait for the lengthy approval process.

Business Lines of Credit: The Financial Safety Net

A Business Line of Credit is basically a credit card for your restaurant. You get approved for a certain amount of money that you can dip into whenever you need it. You only pay interest on what you actually use, and as you pay it back, your available credit goes right back up.

This is the ultimate tool for staying nimble and handling emergencies. A Thai restaurant owner in Hollywood might keep a line of credit on standby. If a commercial refrigerator breaks down during a heatwave, they can buy a new one immediately without blowing up their budget. It's also perfect for grabbing opportunities, like when a supplier offers a limited-time deal on a specialty piece of equipment you've been eyeing.

Choosing Your Path: Pros and Cons of Each Method

Picking the right restaurant equipment financing is a lot like choosing a cooking method for a signature dish. Each option brings its own flavor and results, and what works for a Hollywood Thai spot might not be the best fit for a K-town BBQ joint. The right choice can set you up for growth, while the wrong one can seriously squeeze your cash flow.

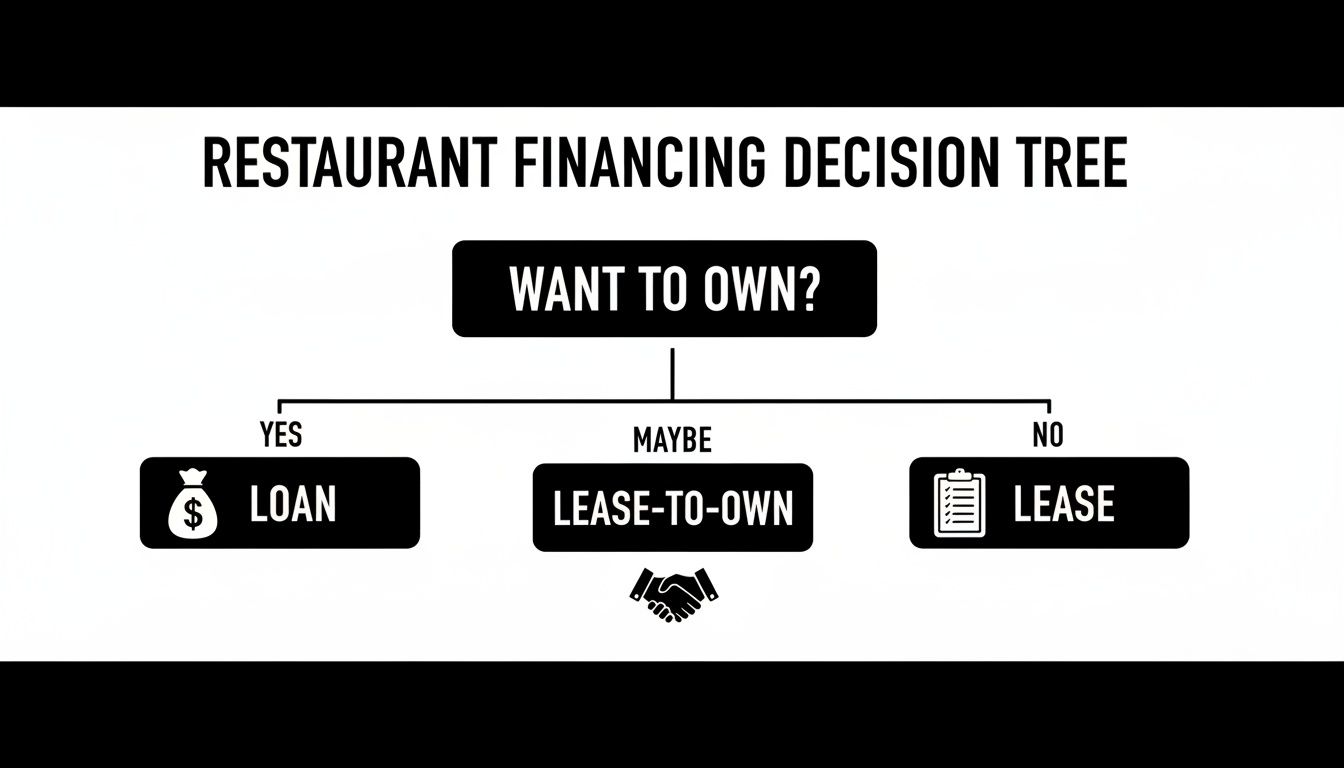

To get started, this simple chart can point you in the right direction based on one key question: do you want to own the equipment in the end?

Think of it as a quick way to narrow down your options so you don’t waste time on paths that don't match your long-term vision.

Comparing Financing Methods Side-by-Side

To help you dig deeper, we've broken down the good and the bad of each financing route. This table gives you a quick, side-by-side look at what to expect, making it easier to see which option aligns with your restaurant's financial health and goals.

| Financing Option | Key Advantages | Potential Drawbacks |

|---|---|---|

| Equipment Loan | - You own the asset from day one and build equity. - Significant tax benefits (depreciation, interest deduction). - Fixed, predictable monthly payments for easy budgeting. |

- Requires a high down payment, often 10-20%. - Tougher qualification standards (good credit, business history). - Your cash is tied up in the initial purchase. |

| Lease (Operating/Capital) | - Very low or no down payment, frees up cash flow. - Easy to upgrade to new technology at the end of the term. - Maintenance and repairs are often included. |

- You don't build any equity; you're just renting. - Can be more expensive than buying over the long haul. - You're locked into a contract for the lease term. |

| Merchant Cash Advance | - Extremely fast funding, often within 24 hours. - Easy to qualify for, even with poor credit. - Payments flex with your daily sales volume. |

- One of the most expensive options with high fees. - Daily payments can strain cash flow during slow periods. - Not a long-term solution; best for emergencies. |

| Business Line of Credit | - Flexible; draw funds only when you need them. - You only pay interest on the amount you use. - Acts as a great financial safety net for unexpected costs. |

- Can be difficult to qualify for with a new business. - Interest rates can be variable and may increase. - Requires discipline to manage and not overuse. |

Ultimately, weighing these points against your specific situation is key. A startup Los Angeles food truck might prioritize the low upfront cost of a lease, while an established, profitable restaurant might prefer the long-term equity and tax benefits of a loan.

The Trade-Offs of Equipment Loans

Going with an equipment loan is the most direct path to ownership. It's a classic move, putting a valuable asset on your books from the get-go. For an established Chinese restaurant buying a new line of high-powered woks or commercial refrigerators, this makes perfect sense.

- You own it, outright. Every payment builds equity. Down the line, you can sell that equipment or even use it as collateral for another loan.

- Tax perks are a big deal. You can usually deduct the equipment's depreciation and the loan interest, which adds up to real savings come tax time.

- Budgeting is simple. Payments are fixed, so you know exactly what you owe each month. No surprises.

But it's not without its hurdles.

- You'll need cash upfront. Most lenders want a down payment of 10-20%, which can be a big chunk of change to tie up.

- They're picky. Getting approved usually means you need a solid credit score and a few years of business history under your belt. It can be a tough sell for a new Los Angeles food truck.

Weighing the Pros and Cons of Leases

Leases are all about flexibility and keeping cash in your pocket. This makes them a hit with businesses that want to stay nimble and have the latest gear. A trendy Japanese sushi bar, for example, might lease its refrigerated display cases to ensure they always look modern and work perfectly.

- Keep your cash. Leases usually require little to no money down, freeing up capital for things like payroll, inventory, or a new marketing push.

- Stay up-to-date. When the lease is up, you can easily upgrade to the newest, most efficient models. Your kitchen never feels outdated.

- Fewer headaches. Many leases roll maintenance and repair costs into the agreement, so an unexpected breakdown doesn't become a financial crisis.

The flip side?

- You're just renting. Once the term ends, you walk away with nothing to show for all those payments. There's no equity.

- It costs more over time. If you add up all the payments, leasing is almost always more expensive in the long run than just buying the equipment.

Balancing Merchant Cash Advances and Lines of Credit

Sometimes you just need money, and you need it now. This is where options like Merchant Cash Advances (MCAs) and business lines of credit come in. Imagine the commercial freezer at your Mexican restaurant dies on a Tuesday—an MCA could get you funds by Wednesday.

A Merchant Cash Advance gives you a lump sum of cash in return for a slice of your future credit and debit card sales. It's incredibly fast but also one of the most expensive ways to get money because of its high factor rates.

A business line of credit is a more structured, less expensive alternative. It works like a credit card for your business, giving you a financial safety net you can tap into as needed.

When you're looking at all your choices, don't forget to consider pre-owned gear. Our guide on financing used restaurant equipment in Los Angeles offers some great insights that can save you money. The best path forward really depends on your immediate needs, your long-term goals, and where your finances stand today.

How to Qualify for Equipment Financing in Los Angeles

Getting the green light for restaurant equipment financing in L.A. isn’t some complicated mystery. It really just comes down to showing a lender that your business is in good shape and that their money is a safe bet. Think of it like a chef showing a new dish to a food critic—the better it looks and tastes, the better the review you’re going to get.

The whole approval process becomes much clearer once you see what lenders actually care about. They're looking for stability, a history of paying your bills, and a solid idea of how new equipment will help you make more money. Whether you’re running a Korean food truck that needs a new griddle or a Japanese restaurant upgrading its commercial refrigerators, these basic principles are always the same.

The Three Pillars of Approval

Lenders in the Los Angeles market tend to zero in on three main things when they look at your application. If you can get these three areas sorted, you’re already on the fast track to getting a "yes."

- Credit Score: Your personal and business credit scores are like a quick snapshot of your financial past. A strong score, usually 650+, will definitely get you better interest rates. But in the fast-moving L.A. food world, there are plenty of options for people with less-than-perfect credit.

- Time in Business: Lenders love seeing a business that's been around for a while. Most like to see at least one or two years of operation because it shows you’re stable. But don't worry, startups aren't out of the game; programs like lease-to-own are made specifically for newer businesses.

- Annual Revenue: Cash flow is everything. A lender needs to see that you have consistent money coming in so you can easily handle the monthly payments. Having clean, organized bank statements that show healthy revenue is a must.

Lenders aren't just looking at numbers on a page; they're evaluating your restaurant's story. A strong application tells a story of a well-managed business with a clear vision for growth, ready to use new equipment to serve more customers and increase profits.

This means that even if you're a bit weak in one area—say, you’re a new Thai food truck without a long history—you can make up for it with strong initial sales and a great business plan.

Your Document Checklist for a Smooth Application

Being prepared is half the battle. Getting your paperwork together ahead of time shows lenders you’re serious and organized, and it can really speed things up. The last thing you want is to be scrambling for documents when you need that new commercial freezer right now.

Here’s a quick checklist of what you'll usually need:

- Business Bank Statements: Typically the last three to six months. This gives a lender a real-time view of your cash flow.

- Business Tax Returns: Your last one or two years will give them the bigger picture of your restaurant's profitability.

- A Detailed Equipment Quote: Make sure it lists the make, model, and total price, including any delivery or installation fees for your new restaurant equipment.

- Driver’s License or ID: Just for basic identity verification.

- Voided Business Check: This is used to set up your automatic payments once you're approved.

Pro Tips to Strengthen Your Financing Application

Besides just handing over the basic documents, there are a few extra things you can do to make your application really shine and boost your chances of getting approved.

First, clean up your credit report. Before you apply, take a look at your report for any mistakes that might be hurting your score. Getting those fixed can give you a nice little bump and lead to much better loan terms.

Second, put together some clear financial projections. A simple, one-page document showing how the new equipment will make you more money can work wonders. For instance, explain how a new high-capacity commercial freezer will let your Chinese restaurant buy ingredients in bulk, cutting food costs and boosting profit margins by 15%.

Finally, write a short business summary. A quick paragraph explaining what your restaurant does, who you serve, and where you're headed adds a personal touch. It helps the lender see the passion behind the numbers and turns your application from just a file into a real story they can get behind.

A Step-by-Step Guide to the Application Process

Getting the financing for your restaurant equipment can seem like a huge mountain to climb, but it’s really just a series of small, manageable steps. Think of it like a recipe—follow it step-by-step, and you’ll get the result you want. This guide will walk you through everything, from figuring out what you need to signing on the dotted line, so you can move forward with confidence.

Having a clear plan of attack takes the guesswork out of the equation and can seriously speed up your approval time. By focusing on one thing at a time, you make sure nothing slips through the cracks and give yourself the best shot at getting the funding your kitchen needs to thrive.

Step 1 Define Your Exact Equipment Needs

Before you even start looking at lenders, you need to know exactly what you’re shopping for. Get specific. Are you a bustling Mexican spot in East L.A. that needs a couple of high-capacity commercial freezers? Or maybe a new Japanese restaurant in Sawtelle that requires a specialized refrigerated sushi display case?

Make a detailed shopping list. Jot down the model numbers, key features, and everything else you need. This isn't just for you; getting an accurate quote is something any lender is going to ask for right away.

Step 2 Gather Your Financial Documents

Once your equipment list is dialed in, it’s time to pull your paperwork together. As we talked about earlier, lenders need to see that your restaurant is in good financial shape. Having these documents ready to go from the start makes the whole process faster and way less stressful.

Create a digital folder with these essentials:

- Business Bank Statements: Grab the last three to six months to show your current cash flow.

- Recent Tax Returns: These give lenders a clear picture of your restaurant’s overall profitability.

- A Formal Equipment Quote: Make sure it lists the total cost, including taxes, delivery, and any installation fees.

A little prep work here saves a ton of frantic searching later and signals to lenders that you’re a serious and organized operator.

Step 3 Research and Select the Right Lender

Now you’re ready to find your financing partner. You've got options, from the big traditional banks to online lenders and lease-to-own specialists. They all have different requirements and offer different kinds of deals.

For a new Los Angeles food truck, a flexible lease-to-own plan might be the perfect fit because of the lower credit score requirements. But an established Chinese restaurant with a strong financial history might go for a bank loan to lock in the lowest possible interest rate. It pays to compare a few options to find the one that truly fits your business.

Step 4 Complete the Application Accurately

After you’ve picked a lender, the next step is filling out the application. Accuracy here is everything. Double-check all your details—business name, address, tax ID, and revenue numbers—to avoid any simple mistakes that could cause delays.

A clean, error-free application is your first impression. Simple typos or mismatched information can raise red flags and slow down the review process, keeping you from getting that essential commercial refrigerator when you need it most.

Step 5 Carefully Review the Financing Agreement

When you get an offer, take a deep breath and read through the entire agreement. The fine print is what matters most at this stage. Be sure you understand the interest rate, the total amount you’ll repay, and the length of the term.

One big thing to look for is a prepayment penalty. This is a fee that some lenders charge if you try to pay off your loan ahead of schedule. Knowing all these details upfront means no nasty surprises later on, leaving you with a financing deal that actually helps your restaurant succeed.

Get Your Equipment with Our Lease-to-Own Program

In the buzzing, fast-paced Los Angeles food scene, having the right restaurant equipment isn't just a nice-to-have—it's everything. Your kitchen's gear, whether you’re running a Thai food truck or a high-end Japanese restaurant, is the real engine of your business. That's exactly why we developed our own flexible restaurant equipment financing solution, built specifically for L.A.'s chefs and owners: our lease-to-own program.

This program is all about getting the professional-grade equipment you need right now, without tying up all your cash. It’s a smart way to bridge the gap between needing top-tier tools and keeping your cash flow healthy.

Think of it like getting the keys to a new car. You make manageable monthly payments and have a clear, simple path to owning it completely. It lets you outfit your dream kitchen for success today, not months down the road.

Built for the LA Food Scene

Los Angeles is a city of culinary dreamers, from Korean BBQ innovators to masters of classic Mexican food. Our lease-to-own financing is designed with that same spirit in mind. This isn't some cookie-cutter loan; it's a flexible road to ownership that understands the unique pressures of the local market.

Here’s how our program helps you grow:

- Conserve Your Capital: Keep your cash for what matters—payroll, inventory, and getting the word out. Instead of one huge upfront cost, you make predictable monthly payments.

- Match Payments to Revenue: Your new commercial refrigerators or freezers start making you money long before your first big payment is due.

- Build Your Business Credit: Making your payments on time can help strengthen your business's credit profile, which opens up more financing options for you later on.

This is more than just buying equipment; it’s about making a smart investment in your restaurant's future. The demand for quality gear is booming, with the commercial food service equipment market expected to hit $68.72 billion by 2029. That growth is fueled by owners just like you investing in reliable ranges, under-counter freezers for food trucks, and efficient pizza prep tables.

A True Partnership in Your Success

We don't just see ourselves as a supplier—we're your partner. Our application is designed to be quick and straightforward, and our team is here to walk you through every step. We want to get you approved so you can get back to what you love: making incredible food.

Our goal is to offer real benefits that make a difference. That means getting you reliable commercial refrigerators and freezers that come with solid warranties and free freight delivery straight to your kitchen.

This approach turns a simple purchase into a real relationship. You get the high-performance gear that can keep up with a busy L.A. kitchen, supported by a financing plan that works for your bottom line. You can learn more about the details in our guide on the benefits of a restaurant equipment lease-to-own program.

Ultimately, our program gives you both the tools and the financial breathing room you need to thrive in one of the world's most exciting food cities.

Common Financing Questions Answered

Let's be honest, navigating the world of restaurant equipment financing can feel like trying to read a menu in a different language, especially in a fast-moving market like Los Angeles. Whether you're upgrading your Korean restaurant’s kitchen or outfitting a new Thai food truck, you probably have a lot of questions. We get it. Getting straight answers is the first step to making a smart move for your business.

This section is all about cutting through the noise. We're tackling the most common questions we hear from local restaurant owners, from credit score worries to the debate over new vs. used gear.

Can I Get Restaurant Equipment Financing in Los Angeles with Bad Credit?

Yes, you absolutely can. While the big traditional banks might slam the door shut if your credit score isn't perfect, plenty of other lenders are much more flexible. They know a credit score is just one number and doesn't tell the whole story of your restaurant.

Financing options like a lease-to-own program, for example, often care more about your recent sales history and how much cash is flowing through your business. You might see a slightly higher interest rate, but it's often a very achievable path to getting that essential commercial refrigerator or freezer without waiting.

How Long Does It Take to Get Approved for Equipment Financing?

This really depends on where you go. When your commercial freezer dies in the middle of a dinner rush, you don't have weeks to wait around. Speed is everything.

- Fast Options (24-48 Hours): Online lenders and lease-to-own programs are built for this kind of urgency. You can often get an answer—and sometimes even funding—within a day or two.

- Slower Options (Weeks to Months): Traditional bank loans and SBA loans are a different story. They involve a much deeper dive into your financials and can take several weeks or even a couple of months from application to funding.

For the breakneck pace of an L.A. kitchen, that quick turnaround from an alternative lender can be a lifesaver.

What Is the Difference Between a Loan and a Lease-to-Own Agreement?

The biggest differences are ownership, upfront cash, and flexibility. Think of it this way: a loan is like getting a mortgage to buy a house, while a lease-to-own agreement is more like renting that house with a plan to buy it down the road.

With a standard equipment loan, you own the gear from day one and your payments build equity. On the other hand, a lease-to-own agreement lets you make regular payments to use the equipment for a specific period. When the term is up, you usually have the choice to buy it for a pre-set price—sometimes for as little as $1. Leasing is a fantastic way to hold onto your cash and stay nimble.

Can I Finance Used Restaurant Equipment?

Of course. Many lenders are happy to finance both new and used equipment. This can be a brilliant move for getting those durable, high-quality workhorses—like stainless steel prep tables or a reliable oven for your Japanese or Chinese spot—at a much lower cost.

Lenders might have some rules about the age or condition of the used gear, and the financing term might be a bit shorter than for brand-new items. The most important thing is to make sure you’re buying from a solid, reputable seller before you sign any financing paperwork.

Ready to get the equipment your Los Angeles restaurant needs with a financing plan that actually works for you? Los Angeles Restaurant Equipment offers a flexible lease-to-own program designed for the local food scene. Explore your options and apply today.